CASH from a 1031 Exchange

You can get CASH OUT plus save taxes in at least three (3) ways with 1031

It's a MYTH that you can't take out any cash with a 1031

The FACT is, that's nonsense! You can indeed get CASH OUT in at least three (3) different SENARIOS with a qualified 1031 exchange

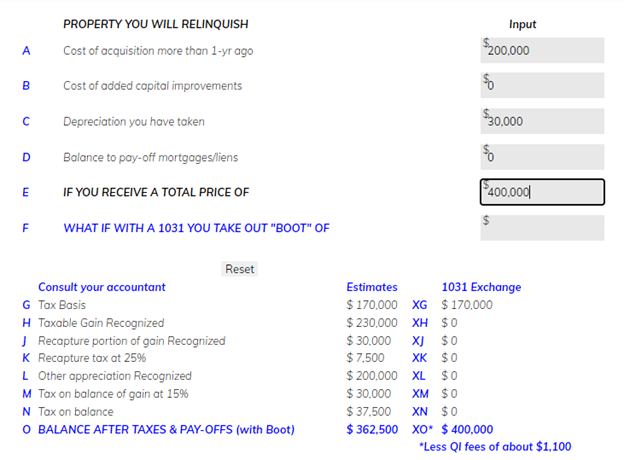

As an example let's say you own a rent house you bought for $200,000, added no capital improvements, have no outstanding mortgage on it but took $30,000 in depreciation so far. And let's say it's now worth $400,000.

If you SELL it then ALL OF THE CAPITAL GAIN WOULD BE TAXABLE...the tax rate on your depreciation recapture would be 25% and the remaining capital gain tax rate would be at least 15%. You can easily calculate an estimate using our Tax Estimating Calculator at:

https://www.1031xc.com/1031-calculator

As illustrated in the estimate below, on such a SALE the tax on the capital gains and recapture would be $37,500 (see N in Figure 1 below).

But also note that with a qualified exchange for like-kind property worth $400,000 NONE OF THE CAPITAL GAIN WOULD BE RECOGNIZED AND NO TAX WOULD RESULT (see XN in Figure 1).

Figure 1. Sale compared to 1031 Exchange

Obviously, with a full qualified exchange for like-kind property worth the same as the property you surrender, you save $37,500 in tax dollars but that gives you NO CASH OUT.

THE FIRST CASH OUT SENARIO is to use a "PARTIAL" 1031 EXCHANGE:

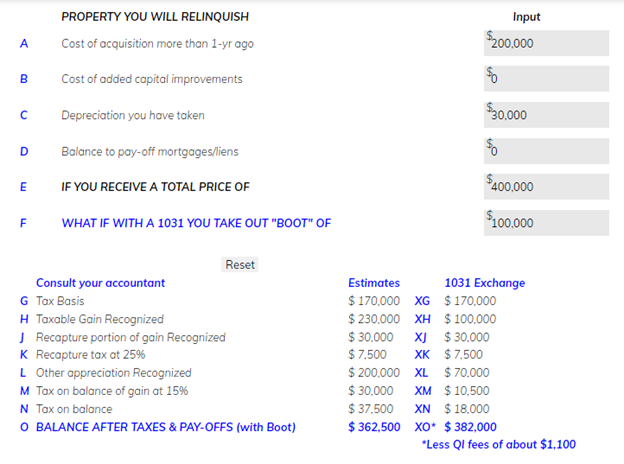

You could make a qualified exchange of your $400,000 property for like-kind property worth only $300,000 plus a CASH PAYMENT of $100,000 to you. The IRS would say that THREE-QUARTERS (3/4) OF THE GAINS WOULD NOT BE RECOGNIZED as taxable (because you got like-kind property worth only 3/4 the value of the like-kind property you exchanged). But the $100,000 cash "boot" would indeed be taxable. Please see Figure 2 below:

Figure 2. Sale compared to a Partial 1031 Exchange

Notice that with this partial 1031, you would still have to pay $18,000* in taxes on the $100,000 "boot" you get (see XN in Figure 2 above) but that's $19,500 less than the $37,500 tax (see N in Figure 2 above) you would otherwise pay if all of the gain was taxed.

*Note that the tax on the full depreciation recovered in the "boot" (XJ and XK above) is charged first.

So the tax with a "PARTIAL 1031" as opposed to the tax payable under a SALE, would save you about $19,500,

With the "partial 1031" you pay the reduced tax to get $100,000 cash boot and own replacement property worth $300,000.

THE SECOND CASH OUT SENARIO is to Borrow After your 1031 EXCHANGE:

But what if you did a full 1031 Exchange (as illustrated in Figure 1 above) with no cash boot. None of your gains would be taxed then and your $400,000 replacement property would be debt-free. Then, after that exchange you use that replacement property as collateral for a tax-free loan of $100,000 (that's only a 25% Loan to Value) and started repaying the debt out of the cash-flow income from your $400,000 property (that should be considerably greater than the income that $300,000 property could earn).

And Notice that not only does the value of that $400,000 property appreciate over time considerably more than the $300,000 property would appreciate but also your $100,000 mortgage is being paid down by its greater income. This serves to "leverage" your investment (and with a higher Loan to Value loan there would be even greater leverage at work for you).

Meanwhile you could use the tax free loan proceeds for anything you want.

THE THIRD CASH OUT SENARIO requires planning Before your exchange:

The reason for considering a 1031 exchange is because the property you intend to surrender has appreciated in value such that you would face a hefty tax on its gain in value if you were to sell it. In most cases that means that even if your credit may not be that good, you probably have considerable "equity" in the property you want to exchange.

Using our first example with a property worth $400,000 without any mortgage debt, you may not be able to borrow $320,000 (that would be an 80% Loan to Value) or even $300,000 (that's 75% LTV) but you might be able to borrow $100,000 (only 25% LTV) if you get any income from the property. And if you could show the lender that you have a $400,000 contract from a qualified buyer, that could be even more persuasion for them to give you the loan.

If your relinquished property (what you surrender) is subject to a $100,000 mortgage when it is sold in your 1031 exchange, that mortgage will be paid off in full out of the sale price.

So you could take your newly acquired replacement property with a $100,000 mortgage and the exchange (of like-kind property worth $400,000 subject to a $100,000 mortgage for your replacement like-kind property worth $400,000 subject to a $100,000 mortgage) is an exchange of equal like-kind properties so no taxable gain will occur. Meanwhile you still have the tax free $100,000 loan proceeds in your pocket.

So you are essentially at the same place you would be if you used the SECOND CASH OUT SENARIO.

Now please "What-If" with our Tax Estimating Calculator at https://www.1031xc.com/1031-calculator and play around with your own case numbers with and without taking out cash and experiment to see if a Partial 1031 with cash boot, or a Standard 1031 with Refinance either Before or After your exchange would be of greatest benefit to you.