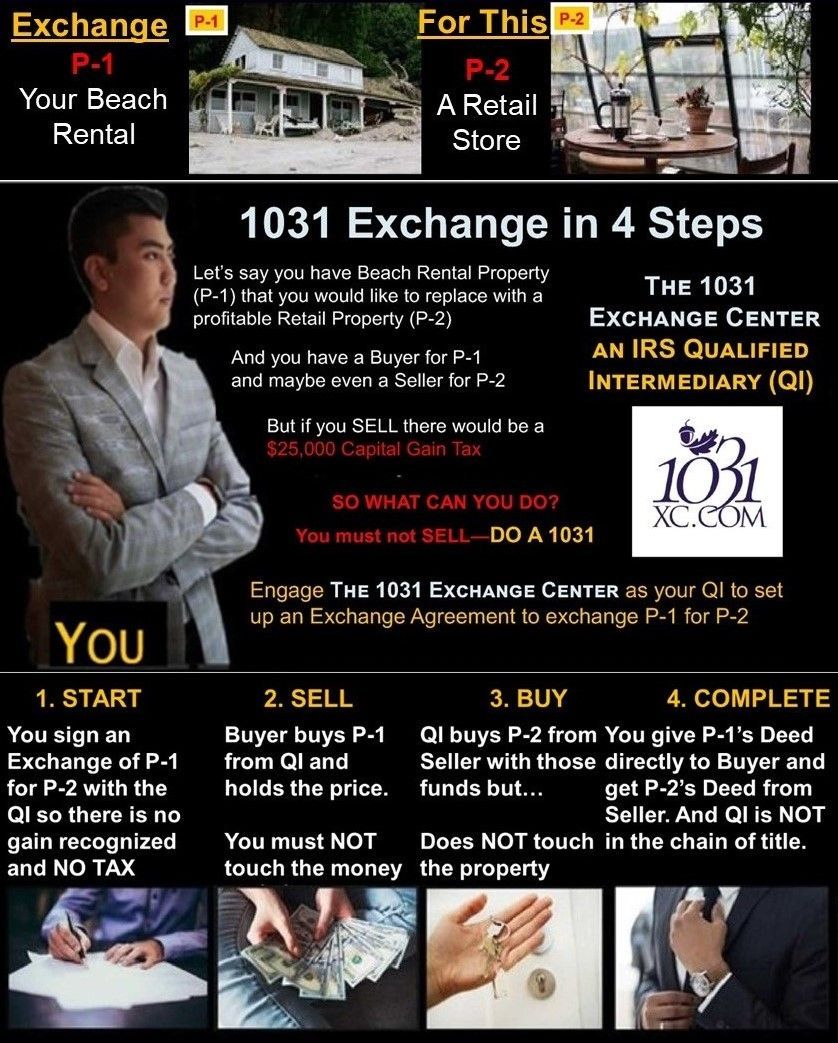

The 1031 Process

You have decided to "REPLACE" a piece of property you own —

You are UNDER CONTRACT to SELL to a BUYER.

You might have some ideas on HOW to replace it

or, you could even be UNDER CONTRACT to acquire a replacement from a SELLER.

If you "SELL" your Property, Taxes MUST BE PAID on the Gain.

But, a 1031 Exchange has NO TAXABLE GAIN

so those saved tax dollars are more YOU can re-invest

So... How do you proceed?

DO NOT SELL!

1. Engage an Intermediary

Set up a "1031 Qualified Exchange"

With an IRS Qualified Intermediary

IRC Section 1031 defines a Qualified Intermediary ("QI") as the

"Fourth Independent Principal Link" between the principals:

YOU, your BUYER, your SELLER and the QI

2. Execute an Exchange Agreement

Your QI will prepare an IRS qualified "Exchange Agreement" with

"Mutually Dependent Parts of an Integrated Transaction Constituting the Exchange".

In it YOU and the QI exchange the two properties.

It involves Rigid & Technical Rules and Deadlines and, has numerous Variations & Exceptions.

The QI MUST Draft the required comprehensive "Exchange Agreement" that can

even permit you to identify the Replacement Property and its SELLER at a later date.

And, it lays out the exact required procedure for a 1031 Exchange...

You Exchange with the QI, the Property to be Relinquished for the Replacement Property.

3. QI sells to BUYER

The exchange agreement having been signed, next the QI SELLS the Relinquished Property to your BUYER,

4. QI buys from SELLER

Then, with the sale funds, the QI BUYS the Replacement Property from your SELLER.

5. Complete the Exchange

And the EXCHANGE between YOU and the QI is completed when the Deed from YOU

is Delivered to your BUYER and the Deed from the SELLER is Delivered to YOU

NOTE: That the QI does not appear in either Chain of Title.

6. Report to IRS

Finally, YOU then MUST file an…

IRS Form 8824

to identify the Exchanged Properties.

This legally transfers your Tax Basis to the Replacement Property,

and declares any "Taxable Boot" you may have received in the 1031 Exchange.