THE MYTH: “Eventually you’ll have to pay the tax”

A tax-deferred exchange does not mean you'll have to eventually pay the tax

It's just a myth...

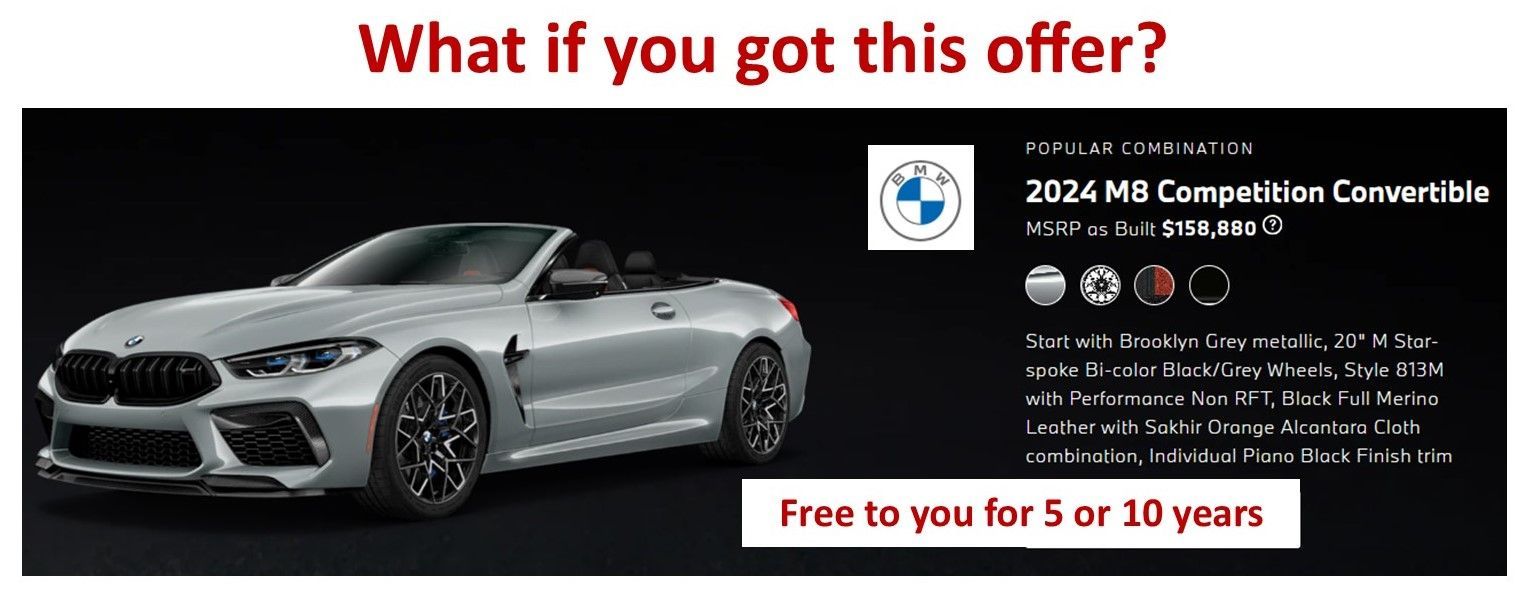

Unlike a sale, a Qualified Section 1031 Exchange is simply NOT A TAXABLE EVENT. Certainly, if you later sell your Replacement Property then the transaction will be a taxable event at that time. Of course, the delay itself in paying the tax is still of value to the taxpayer. The use of those tax dollars during any delay has value. You’d certainly prefer to pay the tax in 5 or 10 years than to pay it all right away.

So, the value to the taxpayer of just the delay (if that’s all you get) could be like the following offer…

Or would you just pay the tax now?

But the Tax Code offers several alternatives to a taxpayer rather than selling the replacement property and paying tax in a lump sum:

- Another 1031: The taxpayer could "exchange" it in another non-taxable event such as another 1031 exchange (you can do them over and over again and in each case the IRS will not recognize "the gain" as taxable).

- A "Partial" 1031: The exchange of "Like-Kind" Property (i.e., real property "held primarily for business or investment purposes") for lesser value "Like-Kind" Property PLUS "TAXABLE BOOT" (the "boot" could be Non-Like-Kind Property or cash or debt reduction) is a partially non-taxable event. Only the "boot" is "recognized" as taxable gain by the IRS. Since only some of the gain is recognized as taxable, that should result in much less tax than if there had been just a sale with no exchange.

- Installment Sale: Taxpayer could "owner finance" a "sale" of replacement property and defer the tax over a number of tax years.

- Charitable Remainder Trust: Put the property into a CRT and take the income (e.g., rental receipts) for life then upon your death the charity inherits the property.

- Conversion of Investment Property to Personal Use: After holding the property primarily for investment or business purposes for some time, you could later decide to convert it to your principal residence or use it as your personal vacation home. [And then, if you sell your principal residence, you might also take advantage of IRC Section 121 and use your $250,000 capital gains exemption ($500,000 if married filing jointly) and perhaps invest those tax savings to refurbish your former investment property.]

- Family Limited Partnership: Set up a FLP (or call it your Family Land Bank) to hold the property and do a gift campaign of partnership interests to your children using your annual gift tax exclusions.

- Stepped-Up Tax Basis upon Death: Although the value of your replacement property may be much greater than its tax basis when you die, its tax basis to your heirs will be stepped-up under tax Law to its value at the time of your death. Which means if you were to sell it before you die you would have a large taxable gain over your tax basis - but the day after your death your heirs could sell it for its full value which will be equal to its "stepped-up" tax basis with no taxable gain.

"Deferred tax" does not necessarily mean you will have to pay it eventually. Consult your tax advisers.

Dollars or Donuts - How do you keep score?

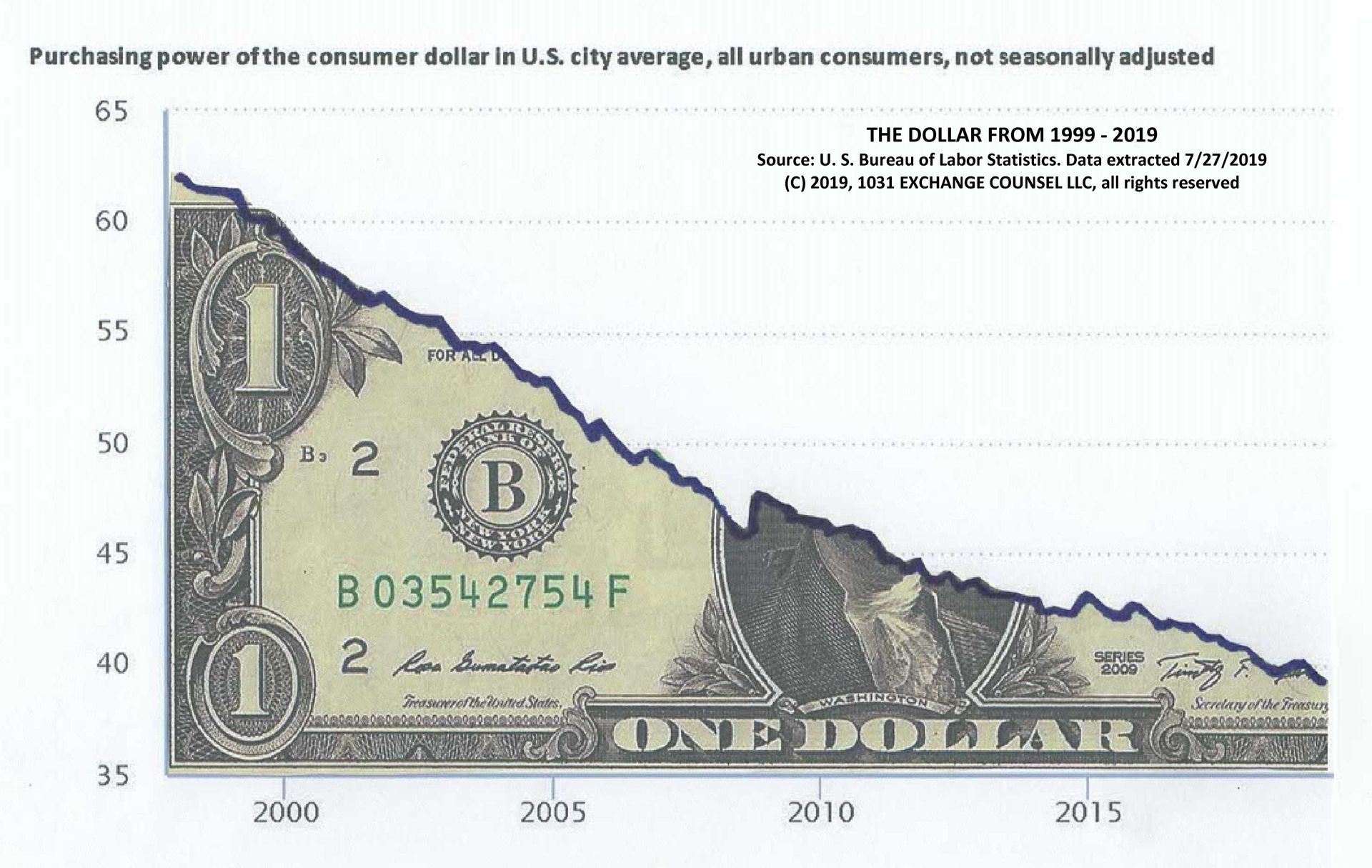

Real estate investors tend to think in terms of rental income potential per square foot. And as dollars tend to devalue over time, rentals tend to increase. So how can you envision the benefit of even simply “delaying” the payment of tax 5 or 10 years? How many more “donuts” (or BMW's) could you buy today than you’ll be able to buy with the same dollars 10 years from now?

As per recent research, U.S. real estate investors can benefit from simply delaying their tax payments for 5 to 10 years. "Rental income" is the favored commodity of investors, and over time, the value of the dollar declines, while rentals increase. By just “delaying” the tax payment, the investor's portfolio continues to grow, and they retain more rental payments until the tax is paid years later with less valuable dollars at a cost of fewer rental payments. This strategy allows investors to maximize their returns in the long run. Therefore, simply “delaying” tax payments can be a lucrative option for U.S. real estate investors looking to grow their portfolio and increase their income.

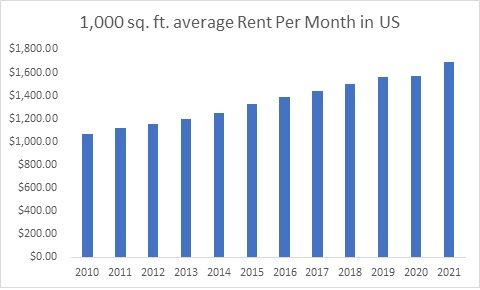

So, a $10,000 tax payment in 2010 would then be equivalent to 9.35 month’s of rental income receipts on your 1,000 sq. ft. unit. But in 2020 that $10,000 could be paid with only 6.35 monthly rent payments. The delay alone will have saved you a "boat-load" of “donuts”. And over the ten years those tax dollars would be growing along with your portfolio.

CONCLUSION

DEFER does not just equal DELAY – a tax that is “deferred” might never have to be paid. So, as mentioned above, with a Section 1031 “tax-deferred” exchange there are a handful of strategies to “liquidate” replacement properties with no tax consequences. Think of a federal "tax deferment" as you would of a "military deferment” - it does not mean the individual will ever have to serve “later” in the armed forces. A "deferred" tax might never have to be paid. But please understand that even a “tax-delayed” arrangement has great economic value.