BENEFITS

When Investors Use 1031's

- Benefit #1 -

GET SOME CASH OUT

(It's a myth that you can't)

Take out Cash as Taxable BOOT with a "Partial Exchange" & Avoid Tax on the rest of your Gain!

Or, get

TAX FREE CASH with an Equity Loan on your Relinquished Property BEFORE the Exchange

or, a Loan on your Replacement Property AFTER your Exchange.

- Benefit #2 -

SEIZE AN OPPORTUNITY

(Grab that offer)

You could accept a buyer's offer without tax on your gain and still have time

to find replacement property usuing "sale" proceeds (with those tax savings)

- Benefit #3 -

INCREASE CASH FLOW

(Better income/less expense)

Choose Replacement Property with

Much Better Income, Better Physical Condition,

Requiring Less Maintenance Expense

- Benefit #4 -

GET GREATER APPRECIATION

(Better growth potential)

Choose Replacement Property in a

Much Better Location for Better Appreciation

- Benefit #5 -

HAVE MORE LEVERAGE

(With the tax savings there's more to re-invest)

Choose More Valuable Replacement Property to

Super-Charge your Investment with

That Tax Money You Didn’t Owe…that will also grow in value!

- Benefit #6 -

CONSOLIDATE/BREAK-UP HOLDINGS

(Solve Problems)

Select Replacement Property Grouped easier to Manage

or Divided into "Parcels" more easier to Distribute

(e.g., to heirs, partners or former spouse)

- Benefit #7 -

EXPAND OR DOWNSIZE

(Fit Your Needs)

Choose Replacement Property with a

Better Configuration and Better Suited to your Plans & Needs

- Benefit #8 -

TO CHANGE LOCATION

(Nearer where you live)

Choose Replacement Property

Closer to (or away from) your Children or

Where you plan to retire

- Benefit #9 -

AVOID BUILDING REPAIRS

(Side-Step needed expenditures)

Exchange property in disrepair for Replacement Property with

Structures in Better Condition

- Benefit #10 -

EASE OF MANAGEMENT

(Less headaches)

Choose Replacement Property with

Professional Management or

Higher Quality Tenants

- Benefit #11 -

FINANCIAL CONSIDERATIONS

(Lender relations)

Choose Replacement Property with a

Better Loan to Value (LTV) ratio

- Benefit #12 -

SMART ESTATE PLANNING

(Thinking ahead)

And you can entirely avoid the "deferred" taxes if the Replacement Property

is exchanged in another 1031 (even again and again) or

with the "stepped up tax basis" if you die,

or if you set up a Charitable Remainder Trust

Build your own Family Land Bank

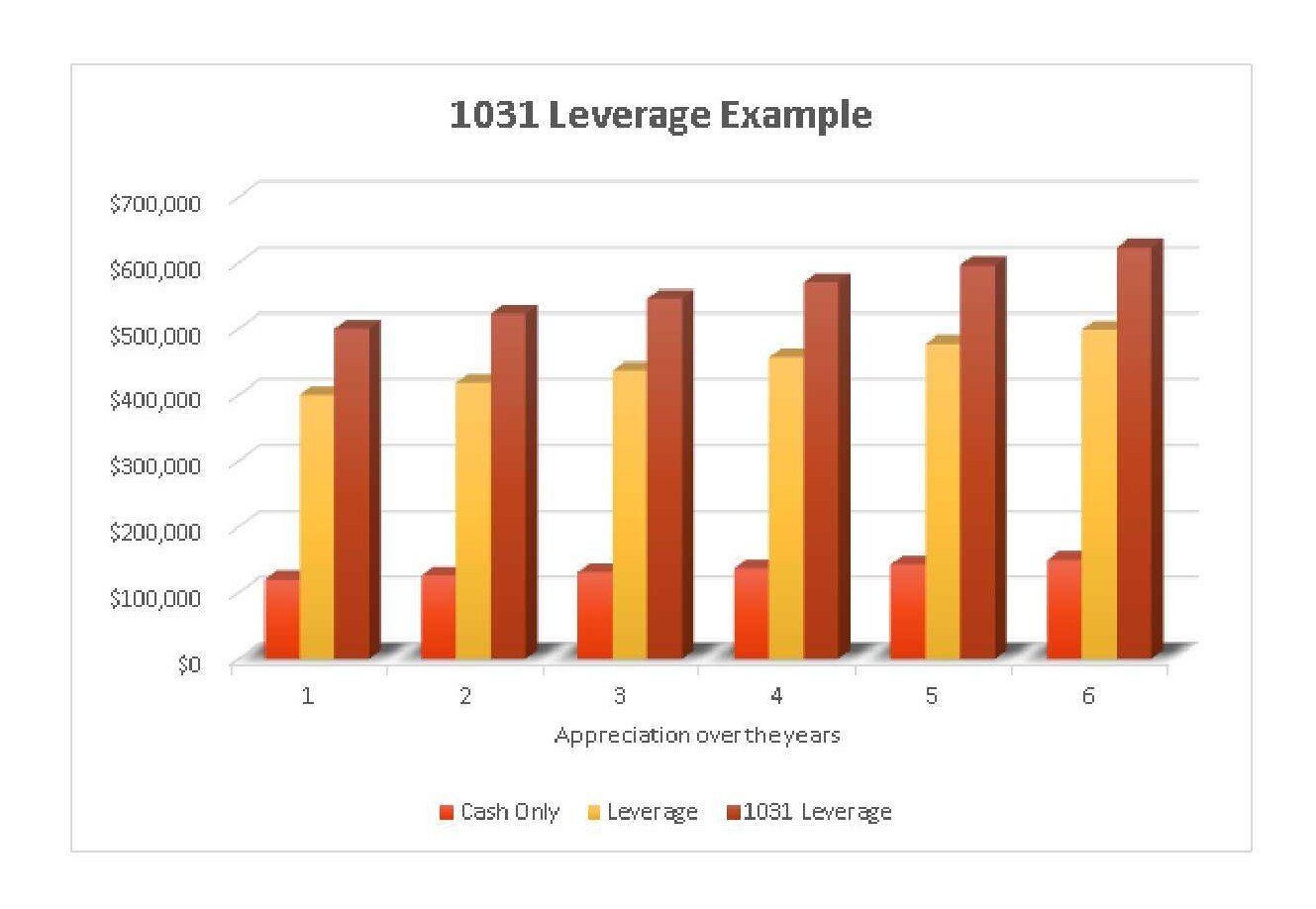

1031 Leverage Example

Let's say you "sell" your Relinquished Property and receive

net proceeds (after $30,000 in tax) of $120,000 cash.

If you then re-invest those proceeds with no leverage in an all cash

Replacement Property valued at $120,000,

If we assume that it appreciates at the rate of 4.50% each year,

In 5 years it would be worth $149,542, that's 24.62% more than your $120,000 investment.

But with leverage you could use that same $120,000 as an

equity down payment

on a 70% loan to value (LTV) loan of $280,000 to acquire

Replacement Property worth $400,000.

Assuming the same 4.50% annual appreciation rate,..

After 5 years it would be worth $498,473,

out of which you could pay off your

$280,000 loan to net $218,473, and that's 82.06%

above your $120,000 investment.

But the leverage could be supercharged with a 1031 Exchange

because that same $120,000 would also be "seeded" or augmented

by the $30,000 tax-deferment so your down payment

now could be $150,000 on a 70% LTV loan of $350,000 to buy

Replacement Property worth $500,000.

Now with the 4.50% annual appreciation rate...

after 5 years it would be worth $623,091, so pay off your

$350,000 loan, you'll net $273.091, that's 187.46% of what

would have been a $120,000 investment.

That extra $30,000 "seed" enabled you to almost triple your money.